How to Draw an Easy Checkbook How to Draw an Easy Cheaklist

Why you can trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We've maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we're putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you're managing your money.

Editorial Integrity

Bankrate follows a strict editorial policy, so you can trust that we're putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you're reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate's editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you're reading an article or a review, you can trust that you're getting credible and dependable information.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life's financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We're transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Insurance Disclosure

Coverage.com, LLC is a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed. Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

ON THIS PAGE

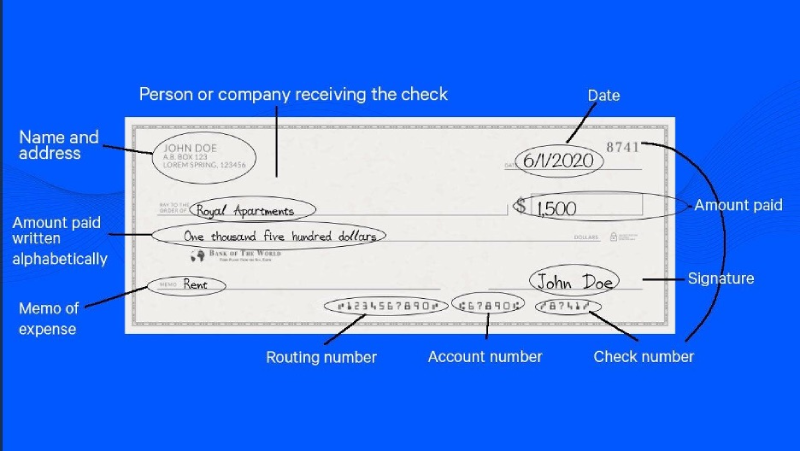

If you haven't written one in a while (or ever), here is a handy guide on how to write a check.

Steps to fill out a check

Many consumers send money electronically these days, but occasionally it may still be necessary to pay by check. Checks can be ordered from banks or third-party printers. Here are the steps to fill one out.

1. Fill in the date

Write the current date on the line at the top right-hand corner. This information notifies the financial institution and the recipient of when you wrote it. The date can be written in long form or all numbers. Either 6/14/2022 or June 14, 2022, could work, for example.

2. Write the name of the payee

On the line that says "Pay to the order of," write the name of the individual or company you'd like to pay, known as the payee. Use the payee's full name instead of a nickname.

If you don't know the exact name, you can write "cash." Be aware that if a check is made out to cash, anyone can cash or deposit it.

3. Write the check amount in numeric form

There are two spots on a check for stating the amount you're paying. The first is a small box to the right of the line for the recipient's name.

Write the numerical dollar amount in this box. For example, you may write $100.30 if you wish to write a check for one hundred dollars and thirty cents. Make sure you write this clearly so that the bank can subtract the correct amount from your account.

4. Write the check amount in words

Next, write out the dollar amount in words on the line below "Pay to the order of," making sure it matches the numerical amount.

Add the cent amount over 100. For example, if you wrote $100.30 in the box, you'll write "One hundred and 30/100." If the check is for $100 or another round number, still include 00/100 for clarity.

5. Write a memo

The memo section of the check is optional, but it's good idea to fill it out because it can serve as a reminder of what the check was for.

If you're writing the check to pay for your for a haircut, for example, you can write "haircut." If the check's for a bill payment, write your account number in the memo area.

A company may ask you to write your account number or invoice number in this section, which helps ensure the payment is applied to the correct account.

6. Sign the check

Sign your name on the line at the check's bottom right hand corner.

Sign legibly and make sure to use the same signature on file at your bank. A signature confirms to the bank that you agree to pay the stated amount to the payee. That's it, your check should be all set to make a payment! (You may also want to check out Bankrate's list of the best checking accounts.)

–Freelance writer Anna Baluch contributed to a previous version of this article.

brucetheatimandid.blogspot.com

Source: https://www.bankrate.com/banking/checking/how-to-write-a-check/

Post a Comment for "How to Draw an Easy Checkbook How to Draw an Easy Cheaklist"